Tell Your Impact Story

Impact Investing with the Rigor of Capital Markets

Impact investing is evolving fast—and so are expectations for transparency and performance. The Impact Evaluation Lab delivers data-driven due diligence that builds trust and confidence, giving investors and fund managers the same rigorous insights they rely on in traditional finance.

What we offer

For Impact Investors

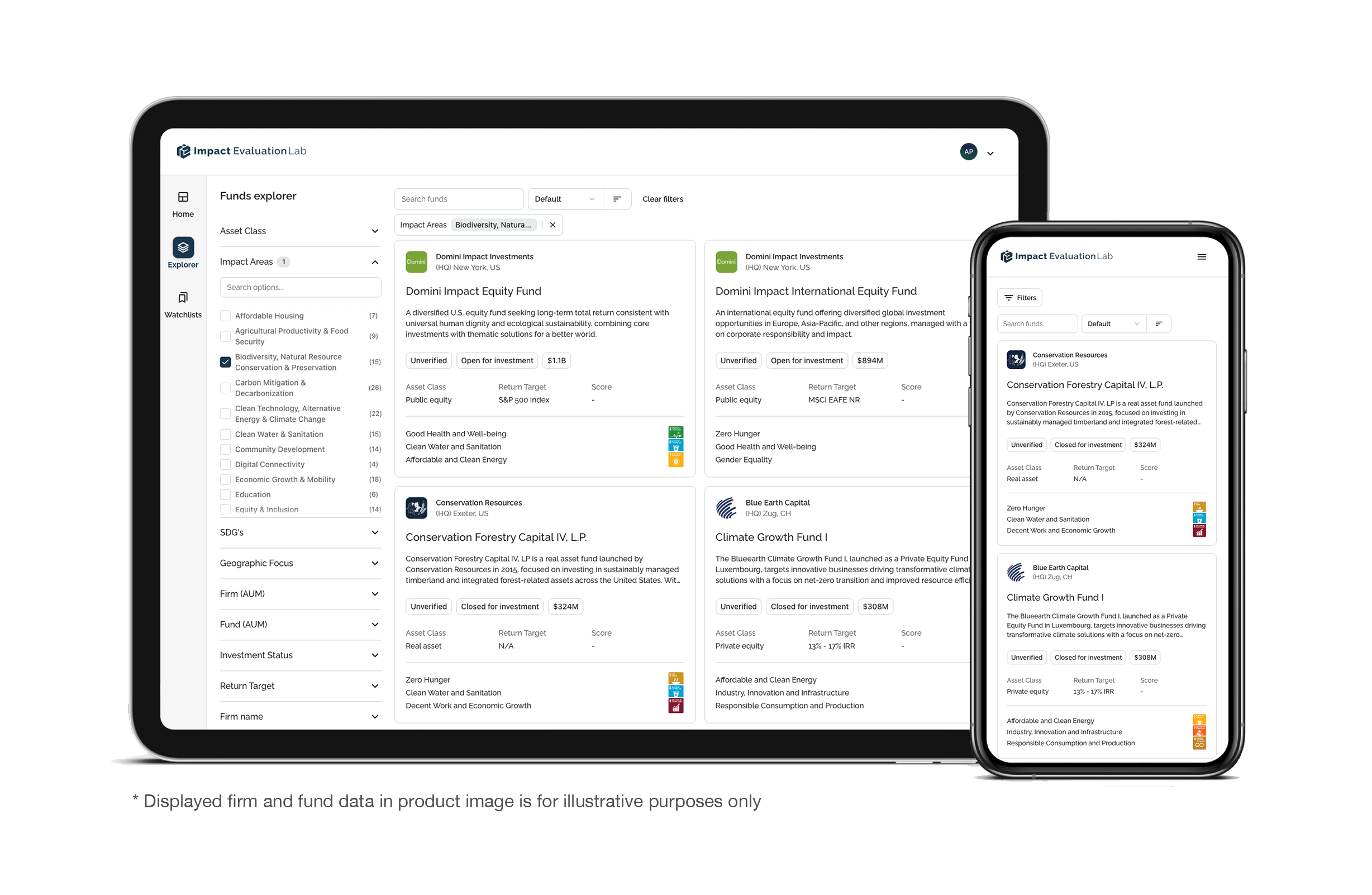

Discover Authentic Impact Funds

The Impact Navigator is a searchable database of today’s most credible impact funds. Filter funds by the issues most important to you. Add funds to watchlists and compare funds across key attributes.

For Impact Fund Managers

Stand out. Build trust. Connect to Capital.

The Impact Evaluation Lab helps fund managers validate their strategies, strengthen investor confidence, and connect with allocators seeking authentic impact.

Impact Investing Today

-

Percent of investors who say that impact washing is a critical issue.

Source GIIN

-

Estimate of total AUM for all impact funds as of 2024.

Source: GIIN

-

Number of global organizations with active impact investments in 2024.

Source: Wharton School

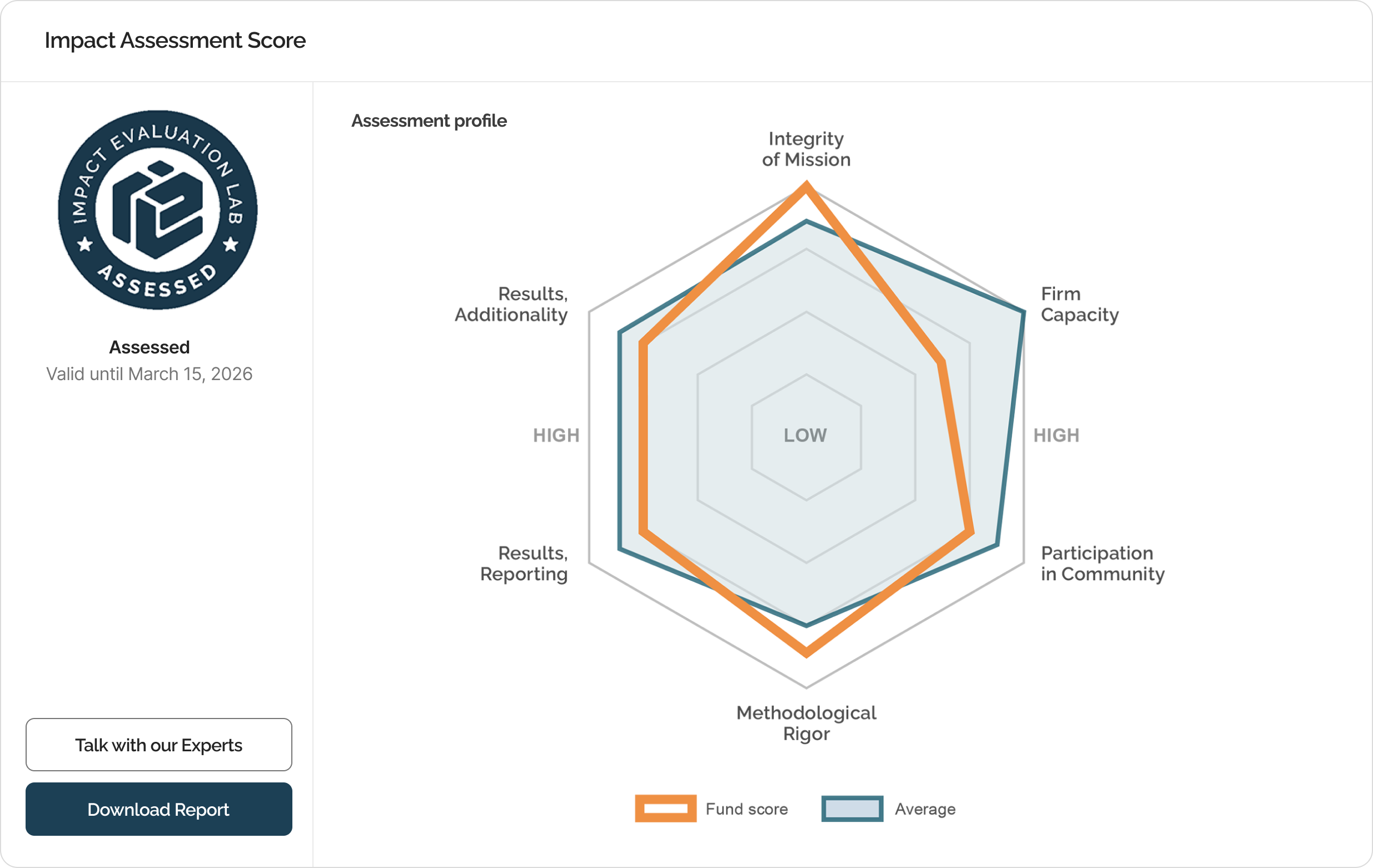

The Impact Assessment Score

Verification & Validation

The Impact Assessment Score (IAS) is our proprietary assessment methodology, designed to evaluate how credibly and consistently a fund delivers on its stated objectives.

Grounded in capital market expectations

The IAS applies a structured, evidence-based framework that examines 49 weighted metrics across three key dimensions:

Mission alignment - Fidelity between stated purpose and investment strategy

Impact execution - Strength, credibility, & consistency of impact measurement, management, and disclosure practices

Financial performance - Consistency in delivering stated financial return objectives

See our report on the Impact Authenticity Score.

The IEL Ecosystem: How Our Products Work Together

Impact Fund Assessment Request

Fund managers request an Impact Authenticity Score or provisional evaluation (for early-stage funds). This includes disclosure of 49 metrics covering mission fidelity, impact execution, and financial performance

Verification & Impact Assessment Score

The Impact Evaluation Lab then conducts a comprehensive review including,

Data validation

Strategy analysis

Document review

Manager interviews

This allows us to independently evaluate how well a fund delivers on its stated goals. Each assessment produces a standardized independent IAS Performance Report, equipping allocators with trusted due diligence insights and providing fund managers with actionable guidance to strengthen future strategy.

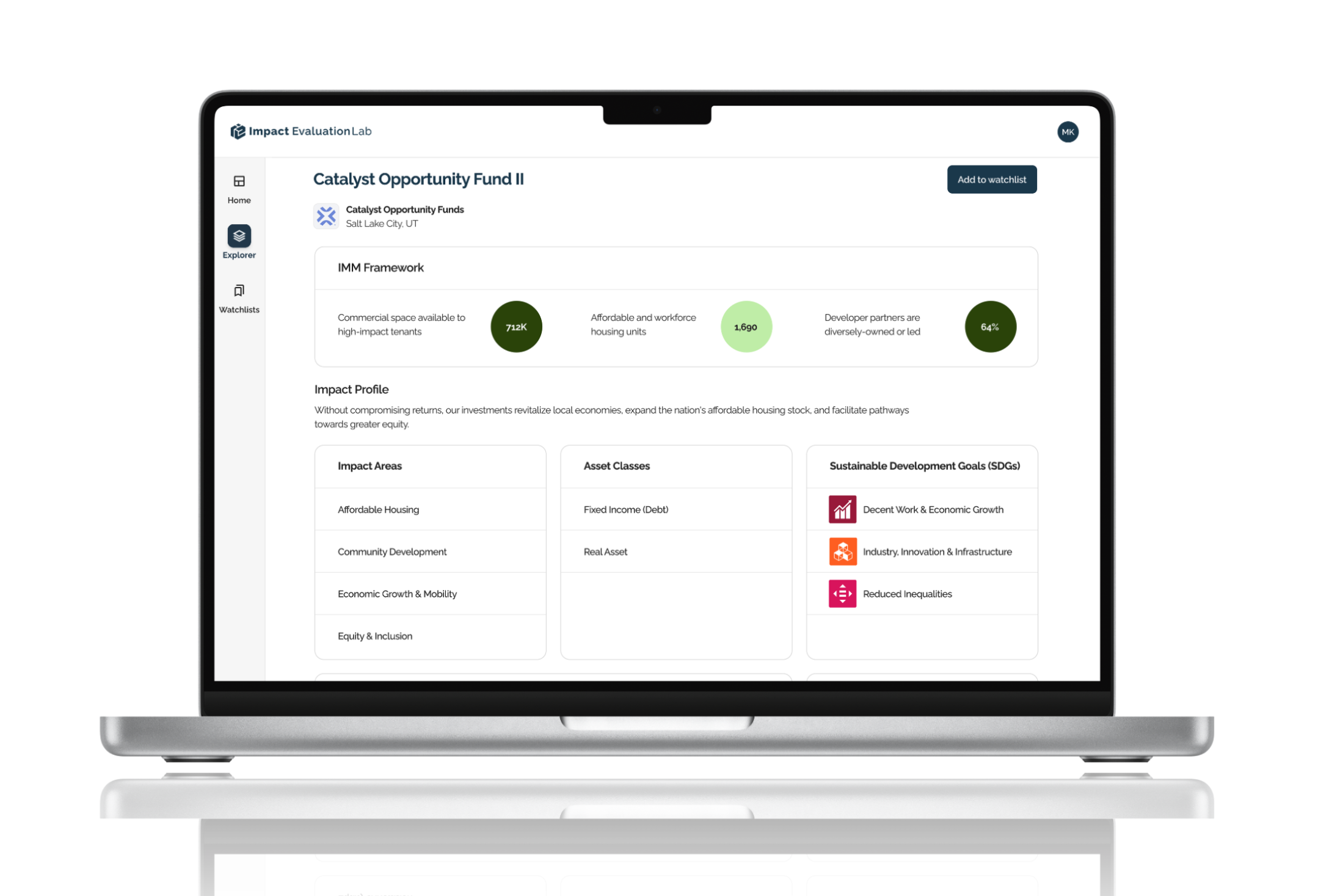

Investors Discover Impact Funds

Assessed funds and the firms behind them are featured in the Impact Navigator Database. Investors can filter funds across 12 different impact dimensions allowing them to identify the funds that best match their objectives. Each Fund also includes,

Verified profiles,

Structured data rooms

Standardized disclosures

This uniquely comprehensive analysis contextualizes both the impact generated by an investment approach and its financial potential — increasing discoverability, trust, and access to capital.

The IEL Difference

Built with the market – Framework developed in collaboration with leading investors, allocators, and fund managers.

Grounded in finance – Methodology designed to meet institutional capital markets expectations.

Third-party validation – Independent assessments, free from marketing spin.

Trust, Transparency, & Accountability – The Impact Evaluation Lab’s unique, comprehensive ecosystem incorporates financial and impact analysis. It builds trust in the market so the sector can attract greater capital flows from capital markets.

Tell Your Impact Story

"The Impact Evaluation Lab's Impact Authenticity Score is a valuable contribution to building structure and intellectual rigor in the impact investment sector. Together with the Sorenson Impact Institute, their team orchestrated a consultative process which gave us the opportunity to review our impact processes in detail and identify areas for growth in the future."

– Jacob Haar, Co-founder & Managing Partner